age1’s 2025 1st Annual Pharma Aging Report Card

Grading the giants on their race to extend human healthspan

Only decades ago, aging research remained a niche curiosity sequestered to a handful of academic labs across the world. But long gone are the days when longevity was a fringe pursuit struggling for funding and mainstream attention. Today, top pharma companies are pouring millions into trials, partnerships, and acquisitions in the longevity space, signaling a fundamental shift in how aging is perceived: from uninvestable to a field poised for near-term progress.

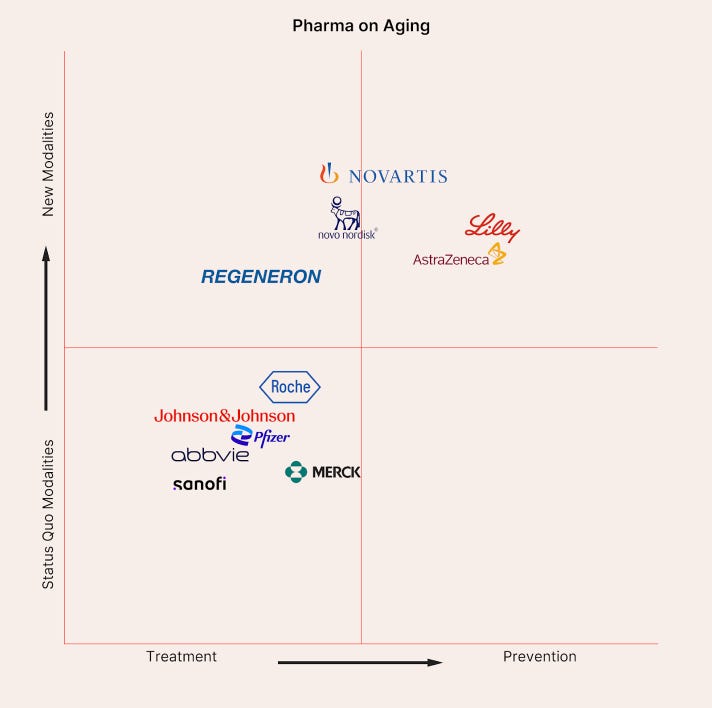

As an early-stage investor, age1 is dedicated to backing individuals—founders with cutting-edge, visionary projects and ideas that could add healthy years and decades to human life. Yet startup audacity and corporate scale are not opposites so much as complements: nimble teams can scout novel mechanisms, while pharma excels at industrializing proven science. Growing corporate interest in the aging field inspired age1 to compile this leaderboard: a map of who inside pharma is leading in longevity, and in what ways.

Why is this list important?

Pragmatically, most early-stage companies would be extremely fortunate to get to Phase I/II trials backed only by VC funding—Series A/B funding may be just enough to run a Phase I and launch a proof-of-concept Phase II before the next round, but to run a Phase III trial can cost hundreds of millions and take multiple years. Unless the company is prepared to IPO with less clinical data, their best bet may be to partner with or be acquired by pharma. Founders who understand which companies have already staked claims in metabolic disease, neurodegeneration, fibrosis, or immune rejuvenation can craft a story that fits those partners’ strategic gap.

We hope that this report card also serves as a call to action for pharma. Facing unprecedented patent cliffs, top pharma companies cannot afford to miss out on one of the very few therapeutic areas with a market size significantly larger than the obesity market. Moreover, large-scale pharma companies have the unique resources and scale to effect transformative change in aging therapeutics through several strategic levers: establishing dedicated internal units focused explicitly on longevity and age-related disease, forging partnerships with innovative startups developing relevant platforms and therapies, directing their venture arms toward promising investments in the aging space, and more. Thus, this report card ideally offers pharmaceutical leaders a snapshot of where bold investment can still capture first-mover advantage and where they sit compared to their peers.

If we have missed any important data or insights that would enrich this article, we invite our audience to share with us; we are always open to feedback!

Without further ado, welcome to age1’s 2025 Pharma Report Card.

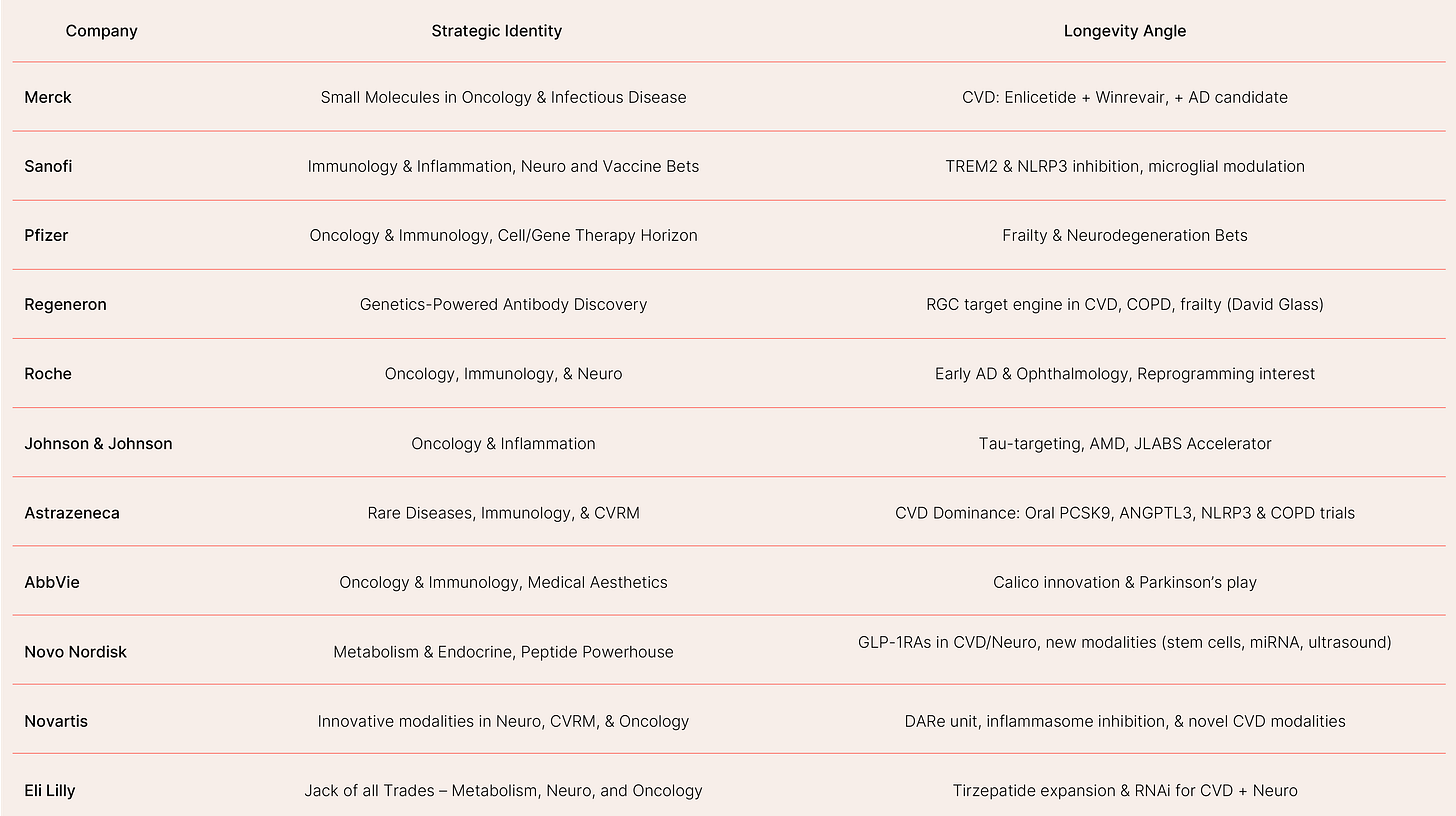

Table 1: Grading Criteria & Quantitative Stats

Note: All corporate partnership deal amounts include upfront payment and milestones (with the exception of Gero x Roche, for which upfront sum was undisclosed). Investment data was sourced from company press releases since 2020, as well as platforms such as Pitchbook, Crunchbase, and Tracxn, and validated by search. For the purpose of this report, "aging-thesis driven" refers to companies that explicitly publicly identify as focused on aging and longevity.

Merck & Co. (C-)

Merck is widely known for its work in oncology and vaccines, as well as its recent successes in treating cardiovascular conditions. The company’s greatest development in the age-related disease space is its development of enlicitide, the first oral macrocyclic PCSK9 inhibitor if approved. This June, Merck announced positive results from the first two of three Phase III trials of the drug, making it highly likely that the drug will soon advance to FDA approval. Alongside enlicitide, Merck is also running a Phase 2a clinical study of frespaciguat, an inhaled soluble guanylate cyclase stimulator for pulmonary hypertension. The company’s leadership in cardiovascular disease extends to its portfolio: in 2021, Merck completed a $11.5 billion acquisition of Acceleron Pharma, securing Winrevair—a first-in-class TGF-β/activin signaling modulator to treat pulmonary arterial hypertension granted FDA approval in 2024. And just this March, Merck entered a licensing agreement for HRS-5346, an oral small molecule Lp(a) inhibitor currently being evaluated in a Phase 2 clinical trial in China.

Merck has generally steered clear of any explicit longevity initiatives, but its venture arm has made modest investments in neurodegeneration. Merck Ventures was also a seed investor in Asceneuron, a spinoff company resulting from EMD Serono’s (a division of Merck) Entrepreneur Partnership Program building enzyme O-GlcNAcase (OGA) inhibitors that prevent the aggregation of tau proteins. Blocking O-GlcNAcylation has been shown to decrease amyloid plaque and improve cognitive function in aged mouse models. Unfortunately, Asceneuron unexpectedly halted its own Phase II trial of lead Alzheimer’s disease (AD) candidate ASN51 this March, but remains hopeful about its other clinical-stage tau-targeting therapies such as ASN90, currently in trials for the treatment of progressive supranuclear palsy. Nonetheless, Merck’s collaboration with Neuphoria on MK-1167, an alpha-7 nicotinic acetylcholine receptor allosteric modulator, remains promising, as the drug is currently in Phase II trials. In 2019 and 2023, the company acquired Calporta and Caraway (formerly Rheostat Therapeutics), respectively, both of which are developing drugs that target TRPML1, a lysosomal ion channel critical for cellular waste clearance. Impaired lysosomal function is increasingly recognized as a central driver of neurodegenerative diseases, including AD and PD, due to its role in clearing misfolded proteins and damaged organelles. However, the payout on these investments, exceeding $500 million each, remains unclear, as Merck has not shared any status updates on the development of its TRPML1 agonist preclinical program.

Merck’s strategy of pouring capital into derisked targets (PCSK9, TGF‑β/activin, sGC) and developing novel formulations (oral, inhaled) has resulted in well-executed, faster time‑to‑revenue drugs in cardiometabolic disease, but the company remains hesitant to bet on aging biology, either internally or externally. Venture investments in neurodegeneration remain aging-adjacent, and, like many of its peers, Merck has not publicized efforts to enter partnerships or collaborations with aging-thesis driven companies.

Sanofi (C-)

Sanofi, traditionally a leader in immunology and neuroinflammation, has taken a somewhat unconventional path into longevity R&D—while the French pharma does not have an aging unit like AstraZeneca or Eli Lilly, it has engaged in trials and investments that demonstrate a recognition that diseases of aging present huge opportunities, particularly in neurodegeneration and inflammation, two fields for which the company is arguably most well-known. Most recent is its May 2025 $470 million buyout of Vigil Neuroscience to acquire VG-3927, a small molecule agonist of the TREM2 protein expected to enhance microglial function in AD. In 2024, Sanofi quietly announced a $27 million investment in Ventyx, which is developing VTX3232, an NLRP3 inhibitor that can cross the blood-brain barrier. Chronic NLRP3 inflammasome activation has been shown to accelerate age-related diseases and conditions such as AD, Parkinson’s Disease (PD), metabolic disease, and even frailty. VTX3232 has already demonstrated success in safety and target engagement trials, with the results of subsequent studies expected later this year. In 2023, Sanofi Ventures also joined Novo Holdings in a $55 million Series B for NodThera, which is developing a similar small-molecule NLRP3 inflammasome inhibitor, highlighting the company’s clear focus on anti-inflammatory therapeutics—notably, 44 of its 86 clinical-stage projects are immunology and inflammation, comprising more than half of its pipeline.

Beyond investments, Sanofi’s clinical pipeline also includes some standouts: Frexalimab, a CD40-CD40L pathway inhibitor, is currently in Phase III trials for the treatment of Nonrelapsing Secondary Progressive Multiple Sclerosis (nrSPMS). Like AbbVie, Sanofi is also developing a gene therapy for wet age-related macular disease (SAR402663), albeit only in Phase I/II. The company is also running Phase I trials of a first-in-class trispecific nanobody for knee osteoarthritis (SAR446959), simultaneously inhibiting key cartilage-degrading enzymes (MMP13 and ADAMTS5) and anchoring the nanobody to the affected cartilage. Sanofi also boasts a promising vaccine pipeline, including three mRNA vaccines for RSV aimed at older adults. In 2022, Sanofi made a blockbuster $1.2 billion deal with Insilico Medicine to advance candidates for up to six new targets using the company’s Pharma.AI platform.

Ultimately, however, Sanofi sits at a C‑ because the company’s work in aging is currently a patchwork of late‑stage, disease‑centric projects (TREM2 for AD, NLRP3 for PD, trispecific nanobodies for osteoarthritis) rather than a cohesive longevity strategy. Sanofi’s alliance with an aging-thesis driven company like Insilico is promising, but it remains unclear whether Sanofi will use the company’s platform to develop assets in age-related disease, and the company has yet to establish an in-house aging group or publicly promote investment in the targeting of aging as a primary condition.

Pfizer (C)

Long known for its strengths in oncology, immunology, and vaccine development, Pfizer has slowly started to position itself as a participant in the longevity space. While Pfizer lacks a specialized aging division, the company has made its commitment to aging research explicit through investments and public campaigns. In 2022, Pfizer Ventures made a $500,000 investment in VitaDAO, a community collective organization that funds longevity researchers. One year later, Pfizer entered a research collaboration with Gero to discover drug targets for fibrotic diseases.

The company’s venture arm has also made four significant investments in neurodegenerative disease therapeutics. In 2017, Pfizer joined AbbVie in backing Aquinnah’s RNA-binding protein approach for ALS/AD as mentioned earlier, and, in 2019, co-led funding in lysosomal dysfunction biotech Arkuda Therapeutics (notably, Eli Lilly joined Arkuda in the following Series B round, making the biotechnology company one to watch). In 2020, Pfizer Ventures invested $15 million into Mission Therapeutics (joining Roche), a biotech developing selective deubiquitinase inhibitors to enhance mitophagy, and just this March, Pfizer contributed to a $31 million seed round for TRIMTECH Therapeutics (along with Eli Lilly), leveraging E3 ubiquitin ligase TRIM21 to degrade protein aggregates responsible for neuroinflammation. One of Pfizer’s most intriguing pipeline candidates is Ponsegromab, a GDF15 monoclonal antibody, which has shown positive Phase II results in cancer cachexia; GDF15 is one of the most consistently upregulated proteins with age. The company’s pipeline also includes drugs such as Dekavil, a precision IL-10-conjugated antibody that exploits fibronectin overexpression in inflamed cartilage; PF-07868489, a recombinant human IgG1 that targets bone morphogenetic protein (BMP9) for pulmonary arterial hypertension; and ervogastat, a first-in-class DGAT2 inhibitor for MASH.

Pfizer has also been highly vocal about advancing aging research, publishing content about longevity-associated genes, and launching its 2012 #GetOld campaign, which encouraged Americans to embrace aging in a world where they envision its therapeutics adding multiple healthy years. There are also rumors that Pfizer hosted an internal R&D retreat several years ago with a longevity theme. However, Pfizer seemingly remains longevity‑curious from the sidelines. Its publicity on healthy aging and small check investments into platforms like VitaDAO and Gero are encouraging, yet its own R&D remains focused on core oncology, immunology, and vaccines, and the company has not signaled any intention to create a dedicated aging unit.

Regeneron Pharmaceuticals (C)

As one of few big‑pharma players that operates an in-house industrial‑scale human genetics engine, Regeneron has the unique capacity to translate protective genetic variants into drugs that target aging and age‑related disease. Although Regeneron’s $256 million bid to acquire 23andMe’s bankruptcy‑auctioned genetic database ultimately fell through, its in‑house Regeneron Genetics Center (RGC) has already sequenced more than 2.7 million de‑identified exomes as of 2025, making the company a genomics powerhouse regardless of the deal’s end result. And indeed, Regeneron has shown the ability to leverage its genetic database for pharmaceutical innovation before. Its development of evinacumab was developed as a result of genetic analysis pointing to ANGPTL-3 LoF mutations as protective against cardiovascular disease. And while not discovered by Regeneron themselves, the company leveraged UT Southwestern’s 2006 finding that PCSK9 LoF variants confer lifelong low LDL-C and reduced coronary risk to develop Praluent, the first FDA-approved PCSK9 inhibitor. Regeneron has similarly leveraged genetic insights into targets for NAFLD (CIDEB, HSD17B13), heart failure and hypertension (NPR1), dyslipidemia (APOC3), and chronic obstructive pulmonary disease (COPD) (IL-4, IL-13). On the investment side, Regeneron completed two notable hundred-million-dollar partnerships in recent years:

Alnylam Pharmaceuticals (2019), a leader in RNA interference therapeutics currently running Phase II trials on mivelsiran, an amyloid precursor protein (APP) siRNA,

Intellia Therapeutics (2023), a CRISPR/Cas9 platform initially acquired for its potential in hemophilia treatment, but now the driving technology behind NTLA-2001, a gene-editing therapy in Phase III trials for transthyretin amyloidosis (ATTR-CM), a cardiomyopathy that rises steeply after age 60.

Regeneron has made great strides in aging under Vice President Dr. David Glass, head of the corporation’s unit studying aging and age-related disorders. Glass’s team has published extensively on the role of ActRII ligands in muscle wasting (the company is currently researching the safety and efficacy of Garetosmab, an Activin A-blocking antibody), laying the groundwork for potential interventions aimed at preserving muscle function in aging populations. However, Regeneron remains seemingly reluctant to take bigger action in the field—for example, we have yet to see an aging-focused company in its public portfolio via the newly launched Regeneron Ventures. Ultimately, Regeneron is doing the kind of work (large-scale multi-omics, gene editing, etc) that could uncover new territory in aging biology, but it’s applying it mostly to conventional disease categories for now, earning it a middling grade.

Roche (C)

Roche (and its subsidiaries in Genentech and Chugai) has been uniquely successful in the diagnostics space, which few pharma companies have entered. In 2024, Roche received FDA Breakthrough Device designation for its pTau217 blood test, co-developed with Eli Lilly. While not a cure, diagnosis before symptomology could allow patients to, at the very least, enter clinical trials while brain tissue is still salvageable. On the investment front, the Roche Venture Fund committed $290 million in 2022 to Freenome, an SF-based company developing machine learning-enabled multiomics blood tests to detect colorectal and lung cancers at their earliest stages. And in 2023, Roche partnered with Alnylam Pharmaceuticals to commercialize zilebesiran, an RNAi therapeutic reducing liver angiotensinogen mRNA levels to lower blood pressure. Roche also recently acquired Carmot Therapeutics, an obesity therapeutics company, for $2.7 billion. Carmot stands out in a crowded market for its “biased agonism” strategy which aims to improve efficacy and tolerability, and Roche is reportedly considering employing the Berkeley-based company’s lead candidate, CT-388, in combination with Roche’s own anti-myostatin antibody RO7204239. Lastly, this July, Roche’s Japanese subsidiary Chugai Pharmaceutical entered a deal with Gero (the aforementioned Pfizer partner), an AI target discovery platform that screens longitudinal data. The agreement includes an upfront payment of $250 million, with potential earnings reaching $1 billion through royalties.

Notable projects in Roche’s pipeline also include, but are not limited to:

Nivegacetor, a Phase II oral gamma-secretase modulator licensed from Merck that lowers amyloidogenic Aβ42 and Aβ40 while increasing shorter, less aggregation-prone Aβ37/Aβ38,

RO7269162, a y-secretase modulator meant to reduce amyloid formation in a 90-week Phase II trial for those at-risk or in the prodromal stages of AD,

The appropriately named GYM-329, an anti-myostatin antibody marketed as a muscle preservation companion in obesity treatment, and

Trontinemab, an amyloid-clearing bispecific monoclonal antibody employing a similar transferrin-receptor BBB shuttling technology to Aliada Therapeutics, heading to Phase III. RO7121932, an anti-CD20 which uses the same BrainshuttleTM as Trotinemab, is currently in Phase I trials for MS.

Already on the market is Roche’s intravitreal injection Vabysmo, a one-time treatment dual VEGF and Ang-2 inhibitor for age-related macular disease and diabetic macular edema, and the first bispecific antibody for any age-related disease beyond cancer.

In 2022, Genentech published a content piece entitled “Turning Back the Clock,” in which the company describes a collaboration with the Salk Institute testing the long-term safety of inducing Yamanaka factors in healthy mice. Near the end of the article, Genentech made a surprising statement: “Our scientists are now exploring whether partial reprogramming can be used to tackle age-related disease.” Since then, members of Genentech’s Regenerative Medicine team such as Drs. Alessandro Ori, Kristen C. Browder, Henri Jasper, and more have put out several publications regarding potential applications of stem cells and modulating Yamanaka factors in vivo, but, expectedly, there hasn’t been any publicity on Genentech or Roche seriously pursuing epigenetic reprogramming as a therapeutic strategy in humans.

Despite the company’s successes in trials and diagnostics, Roche has no declared programs in aging pathology prevention. Nonetheless, Chugai’s recent partnership with Gero to identify antibody targets in age‑related disease is highly encouraging, and the company’s proprietary Brainshuttle technology has high potential to be redeployed across CNS aging indications; taken together, Roche sits comfortably with a respectable C grade.

Johnson & Johnson (C+)

While Johnson & Johnson’s (J&J) may be better known for its leadership in oncology and immunology, the company’s greatest strides in the aging space, like those of its peers Roche and Sanofi, have been largely contained to the arena of neurodegeneration. J&J is the only major pharmaceutical company with two tau-clearing drugs running in parallel: monoclonal antibody posdinemab (currently in Phase 2b, labeled “AuTonomy”) and vaccine JNJ-2056 (in a Phase II trial called “ReTain”), which have both been granted FDA Fast-Track status. J&J stands out for its novel strategies; Posdinemab attacks the phosphorylated-tau mid-domain, an epitope understudied compared to N/ C terminal tau antibodies, and JNJ-2056 is the first immunotherapy approach targeting tau in preclinical AD. J&J is also holding its own in the race to commercialize a gene therapy for age-related macular degeneration with the development of JNJ-1887 (Phase II), designed to increase expression of soluble CD59, an immunoregulatory glycoprotein, to protect retinal cells from geographic atrophy.

J&J is also engaging with aging biology via its venture arm, Johnson & Johnson Innovation – JJDC Inc. Much of JJDC’s capital prioritizes oncology—one of its most notable investments in this field was a 2014 seed investment in Inivata, a UK-based liquid biopsy company that developed a ctDNA test for early lung cancer detection (acquired by NeoGenomics in 2021). But recent investments signal a growing interest in aging-relevant pathways. Ten years ago, JJDC co-led a $33M Series B for Navitor Pharmaceuticals, a platform developing mTORC1 pathway modulators; in 2022, Jannsenn acquired Navitor spinout Anakuria Therapeutics, which is advancing rapamycin analog AT-20494 in ADPKD and other indications. In 2024, JJDC led an oversubscribed Series D for ONL Therapeutics, a retinal degeneration company developing small molecule Fas inhibitor ONL1204 as a therapy for dry age-related macular degeneration. And this January, J&J finally exercised its option to acquire Arkuda's portfolio of lysosomal function enhancers for the treatment of frontotemporal dementia.

J&J’s public visibility in the aging space is also notable: in 2023, the company launched its annual Japan Smart Healthy Aging QuickFire Challenge, which invites Japan-based founders to submit promising science or technologies with the potential to increase healthy life expectancy. J&J committed $300,000 in grant funding, lab access, and mentorship to four startups. While J&J’s commitment to aging in the Asia Pacific region had long evaded the U.S., the New Jersey-based corporation has recently begun employing scientists to research aging and metabolism in its home country, a positive indication of what is to come. Although J&J’s overall footprint in the aging space is narrower than its peers with broader metabolic or cardiovascular pushes, the company’s leadership in neuro & ophthalmology, as well as exciting acquisitions like that of Anakuria, place the company on an encouraging upward trajectory and secure its upper‑tier C grade.

AstraZeneca (C+)

AstraZeneca (AZ), historically concentrated in oncology and Cardiovascular, Renal, and Metabolism (CVRM), has made some of its boldest moves in the longevity space over just the past two years. In 2024, AZ announced a government-backed partnership with the University of Cambridge to establish a new functional genomics laboratory at the Milner Therapeutics Institute (MTI) with the stated goal of “improv[ing] health, ageing, and wellbeing.” Last May, AZ invested in SixPeaks Bio, which is developing dual-specific activin type IIA and B receptor antibodies and marketing itself as the muscle-preserving companion to GLP-1 RAs. AZ committed $80 million in exchange for an option to buy out the company at the time of IND application submission. Earlier transactions include AZ’s $1.8 billion acquisition of CinCor Pharma in 2023, bringing in aldosterone-synthase inhibitor baxdrostat, now in Phase III alongside dapagliflozin, and a 2021 exclusive licence of Dogma Therapeutics’ first-in-class oral PCSK9-inhibitor program (advanced internally as AZD0780, Phase II). Thus, the British-Swedish multinational pharmaceutical giant’s promising catalog of cardiovascular disease drugs currently in trials includes:

AZD1705, a Phase I ANGPTL3 inhibitor for LDL-C management for the prevention of atherosclerotic cardiovascular disease,

AZD4144, a Phase 1b NLPR3 inhibitor in trials for patients with atherosclerosis and chronic kidney disease,

Baxdrostat + Dapagliflozin (Phase III), a combination of an aldosterone synthase inhibitor and SGLT2 inhibitor, respectively, for the prevention of heart failure, and

AZD0780, an oral PCSK9 inhibitor in Phase II with a key advantage over Merck’s enlicitide: the drug would not require fasting before or after taking the medication (enlicitide requires an 8-hour fast before and a 30-minute fast after each dose).

AZ is also investigating the link between cardiovascular disease and COPD prevalence, as well as advancing a Phase III monoclonal antibody, Tezepelumab, for the indication, which targets thymic stromal lymphopoietin (TSLP).

The company’s recent hiring posts suggest an internal shift toward prioritizing aging research, particularly in the context of fighting cancer. As AZ principal scientist Dr. Cindy Guidi wrote in a recent recruitment message, “Why aging, you might ask? Over 60% of cancer cases are diagnosed in those aged 65 and above, highlighting that cancer is fundamentally a disease of aging. However, most preclinical models focus on younger subjects. Our goal is to target the aging pathways to develop preventative and more effective treatments for a broader patient demographic.” This kind of language around aging research from a pharma company is promising, but without broader visibility and aging-centric investments, AZ still has a long way to go before earning a higher grade.

AbbVie (C+)

Best recognized for its dominance in oncology, immunology, neuroscience, and medical aesthetics, AbbVie’s involvement in aging research has been marked by sizable investments with many yet-unrealized returns. The company’s most public venture into the aging space was its partnership with Alphabet to co-fund Calico, a biotechnology company aimed at understanding the underlying biology controlling aging. AbbVie partnered with Calico in 2014 and renewed the investment in 2018 and 2021 with an additional $500 million each. However, Calico has been shrouded in controversy over the decade since its founding—even its creator, Bill Maris, who left Google in 2016, expressed disillusionment with the company’s lack of vision, public transparency, and clinical progress since his departure. Most recently, Calico’s latest ALS drug, Fosigotifator, failed to outperform placebo in Phase II/III trials. The company’s current clinical trials focus on diseases such as Autosomal Dominant Polycystic Kidney Disease (ADPKD) and inherited Vanishing White Matter Disease (VWMD)—worthy causes, but not necessarily linked to aging hallmark biology, raising questions about Calico’s mission alignment.

However, Calico has quietly regained momentum this year with the addition of a patented anti-pregnancy-associated plasma protein A (PAPP-A) antibody to its pipeline. PAPP-A is a protease regulating insulin-like growth factor 1 (IGF-1) bioavailability (the IGF-1 signaling pathway was first implicated in longevity by Cynthia Kenyon, age1 cofounder Laura Deming’s former mentor, who found out that inhibiting insulin/IGF-1 signaling slowed down aging in C. elegans). PAPP-A inhibition has been shown to extend lifespan in mice, and 2020 data by Calico scientists suggest it does so by depleting IGF-responsive mesenchymal progenitors across tissues, thereby reducing fibrosis and other hallmarks of aging. If successful, the antibody could be one of the first drugs on the market to pharmacologically modulate an aging hallmark upstream of disease.

AbbVie has joined smaller bets in the neurodegeneration space, co-investing with Pfizer in Aquinnah Pharmaceuticals, an innovative Cambridge-based company pursuing novel therapies for ALS and AD utilizing RNA-binding proteins, as well as investing in Aliada Therapeutics, which is targeting amyloid via a novel, patented high-precision CNS drug delivery platform—bispecific antibodies dually bind to 3pE-Aβ as well as BBB transport receptor TfR1. AbbVie has also advanced several programs within its PD pipeline, finally gaining FDA approval for Vyalev, a subcutaneous infusion therapy increasing CNS dopamine availability, after multiple resubmissions and a protracted regulatory process. AbbVie has also continued to develop the once-daily oral selective D1/D5 dopamine partial agonist tavapadon in clinical trials. Nonetheless, both therapies aim to address symptoms rather than reverse disease pathology. Slightly more innovative is ABBV-1088, a PINK1 activator (acquired through AbbVie’s buyout of Mitokinin) in Phase I trials designed to address mitochondrial dysfunction in PD. Lastly, AbbVie’s Surabgene Lomparvovec (ABBV-RGX-314), a potential one-time gene therapy targeting VEGF to treat wet age-related macular disease, is currently in Phase III. AbbVie Ventures has invested in multiple companies focused on PD disease treatments, such as Endlyz Therapeutics, Portera Therapeutics, Capsida Biotherapeutics, and Nitrase Therapeutics.

AbbVie also made a strategic 2024 $15 million investment in Oisín Biotechnologies, a Seattle-based company developing genetic therapies to combat frailty by inducing adipocyte-specific apoptosis and delivering DNA follistatin-encoding DNA, antagonizing the myostatin pathway. Oisín has already seen success in preclinical trials, and there is no doubt the company’s value will increase as GLP-1 agonists increase in popularity, creating demand for companion therapies that prevent muscle wasting and improve strength in aging and post-obese populations.

AbbVie, like many of its peers, has yet to develop any in-house geroscience pipeline, nor has it made many public statements about a commitment to aging biology outside of Calico. AbbVie gets credit for recognizing longevity as a field worth funding, but until Calico can translate its strength in basic science to a marketable drug, or internal R&D dedicates a team to aging research, it remains deserving of its C+ grade.

Novo Nordisk (B-)

Novo Nordisk is best known today for its dominance in cardiometabolic disease therapies alongside rival Eli Lilly; however, less publicized is the company’s aim to leverage its GLP-1 receptor agonist franchise into treatments for neuroinflammatory and cardiovascular disease.

Novo is currently funding two Phase III trials (evoke and evoke+) to evaluate the effectiveness of GLP-1RAs against early AD (the two trials reportedly have identical designs, with one difference: evoke+ allows participants with evidence of small vessel pathology (CSVD) on baseline imaging; evoke does not). The trials follow a post-hoc analysis in 2022 showing that patients with type II diabetes treated with GLP-1RAs had a statistically significant 53% lower risk of all-cause dementia diagnosis versus patients receiving placebo. The evoke/evoke+ trials are estimated to be completed in October 2026. If semaglutide can prove to be effective in even a modest slowing of Alzheimer’s, it would be among the boldest successful efforts to repurpose a metabolic drug for brain aging. Novo’s SELECT trial in 17,604 overweight patients without diabetes showed semaglutide cut all major cardiovascular events by 20% and significantly improved mortality outcomes—treatment-group participants had a 4.3% rate of all-cause death after a 3.5-year follow-up compared to 5.2% in placebo. Lastly, Novo Nordisk is also investigating the potential of amylin analog cagrilintide to preserve bone mass in postmenopausal women with obesity using semaglutide.

In addition to GLP-1 RAs, Novo is also pursuing therapeutics for many common targets, including an ANGPTL3 monoclonal antibody and an NLRP3 inhibitor for cardiovascular disease. However, the pipeline projects that stand out are those with unconventional modalities:

STEM‑PD, a Phase I (now Phase II ready) study in eight participants determining the efficacy of intraputamenal transplantation of hESC-derived dopaminergic cells for PD, currently under development by Novo Nordisk’s academic partners.

A T1D DNA vaccine (Phase I) meant to deliver a plasmid encoding pre- and pro-insulin to preserve beta cell function.

CDR132L (Phase II), an antisense oligonucleotide targeting microRNA molecule miR-132 for the treatment of heart failure (the product of a 2024 billion dollar acquisition of Cardior Therapeutics).

FUSE (Phase II), a once-monthly peripheral-focused high-frequency ultrasound (PFUS) treatment for diabetes and obesity meant to regulate glucose metabolism via CNS stimulation (the result of a collaboration with Chicago-based GE Healthcare).

Zalfmerin (Phase II), A long-acting FGF21 analog for the once-weekly treatment of MASH (being developed in collaboration with Omega Therapeutics and Cellularity). FGF21 has long been regarded as a “pro-longevity” hormonal protein—if advanced through Phase III trials, it could become the first FGF21 analog approved by the FDA.

Beyond its ambitious internal efforts to target age-related disease, the Novo ecosystem has also engaged in multiple external initiatives. In recent years, Novo Holdings (Novo Nordisk’s largest shareholder) made several significant early-stage investments in age-related disease prevention, including, but not limited to:

A joint $15 million seed financing round for Booster Therapeutics, a 20S proteasome activation platform aiming to restore the body’s ability to clear AD and PD-associated proteins.

A $100 M Series C leading investment in Asceneuron, the prior-mentioned EMD Serono spinout targeting tauopathies backed by Merck and joined by JJDC in a 2015 Series A.

Participation in a $23 million Series A for Tribune Therapeutics (co-founded in 2020 by Novo Holdings’s Seed Investments team with HealthCap Ventures), a biotech advancing lead candidate and CCN family inhibitor TRX-44 into trials for fibrotic conditions.

Participation in a €80 million Series A for Antag Therapeutics to support development of AT-7687, a once-weekly subcutaneous GIPR antagonist. Importantly, AT-7687 improved glycemic control and lipid profiles independent of weight changes in non-human primates, and achieved weight loss sans GI side effects.

Participation in a 2024 oversubscribed $95 million financing for Lexeo Therapeutics ($1.12 million worth in equity), an NYC-based biotech developing genetic medicine candidates for CVD and APOE4-associated AD.

The Novo Nordisk Foundation is also currently funding grants for PhDs and postdocs studying metabolic aging. In 2023, Novo Nordisk also joined the Hevolution Foundation’s Breakthrough Innovation Alliance, which funds early-stage aging research ideas—Novo sits on the committee that selects projects to receive incubator grants. While Novo Nordisk’s focus is still on specific age-related diseases rather than aging itself, the Danish multinational pharmaceutical company has demonstrated a clear commitment to leveraging metabolic research into broader age-related disease applications and is actively engaging with the early-stage longevity ecosystem through partnerships and investments, earning them a B-.

Novartis (B)

Novartis has shown interest in the longevity space for nearly a decade now. Even in 2014, the company conducted clinical trials of cancer drug and mTOR inhibitor everolimus, exploring its effects on improving the older adults’ immunity following the success of famed mTOR inhibitor rapamycin in extending mouse lifespan. While the trial attracted public interest, it was short-lived—the drug’s patents were nearing expiration before the trial’s end, and Novartis offloaded its aging-focused mTORC1 inhibition program to resTORbio in exchange for an equity stake. resTORbio IPOed in September 2018 and focused on developing RTB101, a selective TORC1 inhibitor, but shortly after the lead candidate failed in 2019 Phase III trials for symptomatic respiratory illness prevention, resTORbio completed a reverse merger with Adicet Bio, an allogeneic CAR-T cell therapy company.

Nonetheless, Novartis has continued to invest in longevity and has made several major moves in the space since then. In 2022, Novartis granted Cambrian Biopharma the license to develop next-generation selective mTOR inhibitors via subsidiary Tornado Therapeutics, a deal that allows Cambrian to advance these rapalogs in aging research while Novartis earns royalties. And a year earlier, Novartis acquired Gyroscope Therapeutics, a gene therapy company developing a one-time treatment for advanced-stage dry age-related macular degeneration. This June, Novartis struck a four-year partnership deal with ProFound Therapeutics, a protein detection platform company, committing $25 million upfront in addition to $750 million in milestones per identified cardiovascular disease target.

In 2023, however, Novartis stepped away from its longtime strategy of acquisitions and IP contributions for a financial stake rather than initiating internal efforts, and launched an in-house unit for Diseases of Aging and Regenerative Medicine (DARe). According to Dr. Michaela Kneissel, who joined Novartis nearly thirty years ago and is now the global head of DARe, the goal of the center is to “understand the biological drivers of aging to develop novel treatments for diseases related to aging.” The unit appears to be currently focused on exercise mimetics, a newly emergent field in aging biology that no other pharma has yet publicly pursued. At the 11th Aging Research and Drug Discovery (ARDD) conference last year, DARe representative Dr. Mara Fornaro shared several ambitious projects in the center’s pipeline, including but not limited to:

LNA043, an FDA fast-tracked ANGPTL3 agonist that stimulates cartilage tissue regeneration in osteoarthritis (a promising project, but discontinued after a poor Phase II readout),

Axatilimab, a colony-stimulating factor 1 receptor (CSF1R) inhibitor targeting inflammatory microglia to reverse age-associated neuromuscular changes,

cGAS/STING (cyclic GMP-AMP Synthase, Stimulator of Interferon Genes) pathway inhibition (the small molecules for which were acquired for $90 million last year following a 2019 option and collaboration agreement with parent company IFM Therapeutics). cGAS/STING pathway upregulation drives excessive interferon/cytokine signaling linked to several age-related diseases.

Novartis’s DARe group is also recruiting researchers into its Basel-based Postdoctoral Fellowship Program, which aims to discover new methods for maturing patient-derived iPSC neurons to full adulthood and then accelerating their aging to model neurodegenerative pathologies for target discovery.

Novartis’s pipeline includes two neurodegeneration trials to watch: a Phase I tolerability study of NIO752, an intrathecally administered tau-targeting antisense oligonucleotide, for the treatment of early AD, and VHB937, a macrophage-specific TREM2-activating monoclonal antibody in Phase II for the treatment of ALS. Like Sanofi, Novartis appears highly focused on targeting inflammation as a root driver of aging—in addition to the above, DARe is also developing DFV‑89, an oral NLRP3 inflammasome inhibitor, and RHH‑646, a novel stimulator of cartilage tissue regeneration in knee osteoarthritis. The small molecule’s mechanism of action has not yet been made public, but it is a significant milestone in pharma’s growing acceptance of regenerative medicine in diseases of degeneration. Having discontinued the drug in a Phase II trial for IPF last year, Novartis is now progressing LTP001, an E3 ubiquitin ligase SMURF1 inhibitor, through Phase I/II for pulmonary arterial hypertension. And in 2021, Novartis's inclisiran became the FDA's fourth approved siRNA-based drug, and the first-ever siRNA approved for LDL-C reduction. The drug, developed under a license and collaboration agreement with the aforementioned Alnylam Pharmaceuticals, was revolutionary for its twice-a-year dosing regimen. Inclisiran is currently in trials for the primary and secondary prevention of cardiovascular events in high-risk patients. Novartis has also launched clinical trials of pelacarsen (TQJ230), an antisense inhibitor of apolipoprotein (a) synthesis, designed to reduce LDL‑C, lower lipoprotein (a) levels, and ultimately cut major adverse cardiovascular events (MACE).

In 2024, Novartis entered a collaboration with BioAge Labs, involving a $20 million upfront payment and potential future earnings of up to $530 million. The partnership, as stated in BioAge's press release, aims to combine "BioAge's extensive proprietary human longevity datasets and Novartis expertise in exercise biology." Paired with Novartis's early mTOR work, its dedicated DARe unit, and prevention‑focused cardiovascular trials, Novartis shows a consistent willingness to engage with fundamental aging mechanisms as well as put risk-reduction and resilience first in clinical trials, a visionary strategy not many of its peers are willing to follow just yet.

Eli Lilly (B)

On the product front, 2023–2025 has been extraordinary for Lilly. The company gained FDA approval for Zepbound (tirzepatide), a GLP-1/GIP twincretin, in 2023; this June, the company announced positive safety and efficacy results for Orforglipron, the first oral small molecule GLP-1 to successfully complete a Phase III trial. ACHIEVE-1 is only the first of seven Phase III trials for the drug, which is also being investigated as a potential treatment for obstructive sleep apnea and hypertension in obese adults. As is Novo Nordisk with Ozempic, Lilly’s tirzepatide has shown success in cardiovascular health trials, boasting a 38% reduction in heart failure, and notably, tirzepatide demonstrated superior weight loss compared to semaglutide in head-to-head trials. Ongoing trials such as SURMOUNT-MMO (Phase III), a landmark morbidity and mortality study in obesity, are positioning tirzepatide not just as a weight loss drug, but as a platform for systemic risk factor compression. In addition to cardiometabolic disease, Lilly is currently running trials dedicated to understanding tirzepatide’s impact on osteoarthritis, psoriasis, and MASH, all diseases with age as a primary risk factor.

At the 2023 Aging Research and Drug Discovery (ARDD) conference, Lilly VP Dr. Benjamin Yaden strongly advocated for the treatment of aging-related processes as a strategy to prevent disease in a discussion panel with Novo Nordisk Senior Director Erik Vernet. The company puts its money where its mouth is—Lilly’s 2025 pipeline is firing on multiple cylinders (cardiometabolic health, neuroinflammation/degeneration, and gene therapy) to conquer age-related diseases. RNA-targeting treatments have also become a strong point for Lilly as the corporation advances projects such as:

Microtubule-Associated Protein Tau (MAPT)-targeting RNAi therapy for tauopathies,

siRNAs targeting triglyceride lipase PNPLA3 and cholesterol sensor SCAP, key regulators in MASH pathophysiology, and

The ANGPTL3 siRNA solbinsiran. As of this April, at least nine distinct ANGPTL3-targeting therapies have entered trials since the first-in-class drug was approved in 2021.

The company’s corporate business development page also highlights “longevity-related indications” as an area of interest within its cardiometabolic health unit, as well as “sarcopenia,” mitochondrial health,” and “next generation oral injectable approaches on myocardium and heart function, e.g., mitochondrial function, inflammation, repair/regeneration,” exciting avenues for future research.

As was mentioned earlier, Eli Lilly is invested in lysosomal enhancement innovator Arkuda Therapeutics alongside Pfizer. Eli Lilly’s internal pipeline efforts in the neurodegeneration space have also proven successful, with Donanemab (Kisunla™) becoming the third amyloid-targeting pharmaceutical to receive FDA approval last July—Lilly is currently recruiting participants for a Donanemab trial in patients with preclinical AD. The company has also partnered with Juvena Therapeutics and acquired Versanis Bio in its effort to develop therapies that preserve muscle mass in the pursuit of weight loss. Versnais Bio bought bimagrumab, an activin type II receptor (ActRII), from Novartis in 2021 after an unsuccessful Phase II/III trial for sporadic inclusion body myositis. Years later, Lilly integrated bimagrumab into its own Phase II pipeline for obesity, signaling a clear understanding of the metabolic–musculoskeletal implications of its GLP-1 therapies. This June, Lilly announced the results of Phase II trials for a combination therapy of semaglutide and bimagrumab, reporting highly encouraging results: participants in the highest-dose cohort lost 22% of their body weight over 72 weeks, with an impressive 93% attributed to fat loss. Lilly is also advancing Phase I trials of ActRIIA antibody LAE102 in healthy postmenopausal women as part of a collaboration with Laekna Therapeutics. In December 2023, Lilly entered a multi-year partnership with FaunaBio to apply its Convergence AI platform to identify novel targets in obesity treatment.

This January, Lilly committed up to $780 million in a global licensing deal with Mediar Therapeutics, a Boston-based biotech developing MTX-463, an anti-WISP1 antibody for the treatment of idiopathic pulmonary fibrosis (IPF). WISP1 is a matrix protein significantly upregulated in age-related musculoskeletal diseases; as such, WISP1 holds great potential as a novel therapeutic target. Mediar is also developing an anti-fibrotic targeting matricellular protein SMOC2, a novel target for fibrosis diseases. In 2024, Lilly joined a16z and others to finance a $43 million Series A for Arda Therapeutics, a San Francisco-based biotech developing cell-depletion therapies for age-related chronic diseases.

Most recently, Eli Lilly acquired Verve Therapeutics, a Boston-based company producing genetic therapies for cardiovascular disease, for $1.3 billion. While Verve is still focused on disease treatment at the moment, company leadership does envision a future in which its gene editing technologies are utilized to prevent age-related phenotypes and diseases. Verve’s lead program (VERVE-102), currently in Phase 1b trials, is an in vivo gene editing therapy targeting PCSK9, promising a “one-and-done” treatment method. Verve, and thus Eli Lilly’s strategy, stands in juxtaposition to that of last-place finisher Merck, whose peptide-based approach to PCSK9 inhibition lacks the ambition and future-oriented vision of pioneers like Lilly, granting it one of the highest grades on our report card.

Takeaways

Taken together, age1’s report card reveals an industry that has crossed the line of intriguing but unactualized research to clinical development. Most major players we scored are investing millions, if not billions, into next-generation therapies for age-related diseases. Our top performers, however, are companies that have made aging biology an explicit focus, whether through public visibility efforts, pipeline standouts, partnerships, investments, acquisitions, internal platforms, or any combination of the above. Novo Nordisk has managed to parlay its GLP-1 franchise into a broader metabolic aging strategy. Novartis’s DARe group has already displayed impressive progress in its aging pipeline, and the BioAge Labs collaboration is certainly one to watch. In a pharma panel on preclinical development at the 2024 Aging Research and Drug Discovery (ARDD), Eli Lilly reportedly publicly announced a commitment to being a “longevity company,” a major tonal shift for the industry as a whole, and an exciting sign of what may be to come. It is also telling that representatives from our three top picks have been selected as speakers for ARDD 2025, highlighting their leadership in the field.

Large pharmaceutical companies have advantages in the longevity arena: they have vast capital to finance large-scale trials like Novo Nordisk’s SELECT that smaller biotechs could never afford. They also possess seasoned clinical development teams and established relationships with both payors and agencies like the FDA, accelerating complex approval processes—their track record of established market therapies gives them leverage to negotiate new drugs. Perhaps above all, pharma giants can acquire proprietary data on a scale unattainable to most startups. In the age of artificial intelligence, the ability to mine millions of genomes may be the decisive advantage for discovering novel targets. As aging has long been known to be highly polygenic and polyomic, companies like Regeneron and Novartis, with resources like the Regeneron Genomics Center and BioAge’s proprietary longitudinal data, respectively, will propel massive breakthroughs in the coming years.

It would be naïve not to spell out why many large drug makers still hesitate to run trials in aging and resilience. For one, a McKinsey analysis of the top 36 biopharma companies’ assets launched since 2000 found a significant reduction in the average time assets took to accrue 50% of lifetime sales. In fact, most drugs reach 80% of their lifetime sales just ~35 months post-launch. This means that in an era of rapid clinical development and competition, R&D must promise fast monetization, putting pressure on pharma to generate revenue by turning to later-stage assets showing preliminary clinical efficacy with a defined regulatory and commercial path, criteria where aging therapies fall short today. McKinsey also notes that these data are compounded by loss-of-exclusivity (LOE) pressures. Blockbuster patents for drugs like Keytruda, Eylea, and Stelara, each generating billions annually, will soon go generic. Add to this the fact that payor economics are currently misaligned with prevention—the average insurance turnover for a commercially covered patient switches every three years, dissuading payors from covering a therapy with benefits that might not materialize for decades. These bottlenecks explain industry caution, but they also highlight actionable opportunities for pharma. Companies prepared to invest in discovering surrogate endpoints, work to select cohorts with higher baseline risk, and implement multimorbidity endpoints to reduce sample size requirements, and engage in early-stage discussions with the FDA about trial design (e.g., running adaptive trials in aging to allow for fast iteration) may reduce risk by bringing aging drugs to meaningful readouts sooner.

Because the FDA still treats aging as a biological process rather than a condition, there is no established regulatory pathway (or U.S. reimbursement precedent) for a drug whose primary claim is “slowing aging” in humans. Excitingly, however, the ICD-11 codes now list “ageing associated decline in intrinsic capacity,” That code is not yet recognized in U.S. billing systems, but could be adopted soon. However, until then, large companies continue to channel capital toward aging-adjacent indications such as osteoarthritis and HFpEF, where endpoints and price benchmarks already exist. Truly paradigm-shifting longevity advances such as epigenetic reprogramming, menopause delay, and regeneration of post-mitotic tissue are largely absent from pharma pipelines because such projects lack an obvious regulatory path. Startups are not immune to this constraint, but equity financing may let them chase bold biology first and pin a conventional “proxy disease” label on the asset later in development.

Because the regulatory environment remains nascent and ill-defined, pursuing aging does inherently require that founders and pharma take on more risk in pursuing targets in this space. But the payoff can be immense (see age1’s 2023 market analysis). When the first GLP-1 agonist therapies for weight loss (Novo Nordisk’s Saxenda) arrived in 2014, the commercial landscape for it did not yet exist. There was no HCPCS J‑code (today, GLP-1 receptor agonists fall under code C5015-A), and most insurers refused to cover the treatment. Nonetheless, as more efficacious alternatives began to emerge in the early 2020s, the commercial environment was forced to adapt. By 2024, 18 % of large employers covered GLP‑1s for obesity (up sharply from single-digit estimates pre-Wegovy), and 15 states now cover GLP-1s in their Medicaid program. Longevity is at a similar pre‑infrastructure frontier. Pharma companies, with their scale and commercial familiarity, are in a unique position to surface transformative, mechanism-validated interventions through internal build, minority equity stakes, and M&A. Therefore, we contend that pharma companies should begin deploying capital into high‑potential aging-thesis driven platforms now. With patent expiries looming, competition intensifying, and development timelines tightening, early movers have the opportunity to shape the clinical and commercial landscape for an entire class of drugs and advance the next inevitable frontier in therapeutics development. Prove efficacy, and reimbursement and access frameworks will adjust accordingly.

Appendix:

While this article aimed to be as comprehensive as possible, there were several pharma companies we could not profile (Bayer, BMS, GSK) for the sake of article length, as well as many notable recent investments, collaborations, partnerships, and acquisitions in the age-related disease space made by many of the pharma companies profiled and their respective venture arms that we were unable to profile exhaustively here. These include:

AstraZeneca: Cincor Pharma, Icosavax, Caelum Biosciences, Dogma Tx, Silence Therapeutics, Ionis Pharmaceuticals, CSPC Pharmaceutical Group, Redx Pharma

Eli Lilly: Solu Therapeutics, Therini Bio, Prevail Therapeutics, Ampersand Biomedicines, Disarm Therapeutics, Haya Therapeutics, Laverock Therapeutics, Nido Biosciences, Regor Therapeutics, Orso Bio

JJDC: Cardiac Dimensions, AviadoBio, Nanochon, SpectraWAVE, CuraSen Therapeutics, Perceive Biotherapeutics, Shockwave Medical, Anakuria Therapeutics

Merck: TRIMTECH Therapeutics, EyeBio, Cerevance, Acceleron Pharma

Novartis: Anthos Therapeutics, AstronauTx, Borealis Biosciences, FundaMental Pharma, ONL Therapeutics, Pliant Therapeutics, Regulus Therapeutics

Novo Nordisk: Avalyn Pharma, AnaCardio, NorthSea Therapeutics, Muna Therapeutics, Tanai Therapeutics, Eikonizo Therapeutics, Gensaic, Aspect Biosystems, Dicerna Pharmaceuticals, Corvidia Therapeutics

Pfizer: ReViral, Mediar Tx, MindImmune, Voyager

Sanofi: Vicore Pharma, Resalis Therapeutics, AgonAb, Gyroscope, Therini Bio, Vicebio

A huge thanks to Satvik Dasariraju and Alex Colville, who pored over each draft, filled any gaps, and guided the direction of this piece. Thank you to Lily Clayton as well for the beautiful graphics! Lastly, special thanks to Lauren Nam for sharing her unique perspective on the obstacles faced by pharma.

Table 2: Strategic Identities of Profiled Pharma Companies